This information involves the South African Revenue Service (SARS) online registration portal: www.sars.gov.za. It also contains the organization’s contact address and the official website. Kindly check below for more details.

The Authority has enabled the online registration portal for tax and customs payments in South Africa. The Online Portal is created for prospective and existing tax payers in South Africa to create an account or log in to perform certain actions at ease, e.g., tax registration, account balance, status, renewals, and so much more.

- Increased Customs and Excise compliance

- Increased tax compliance

- Increased ease and fairness of doing business with SARS

- Increased Cost effectiveness and Internal Efficiencies

- Increased public trust and credibility.

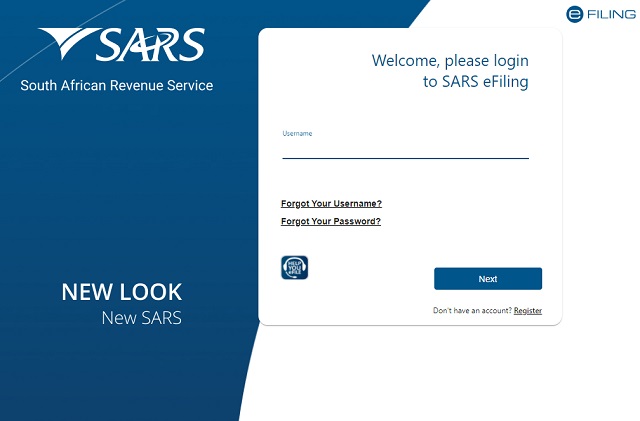

HOW TO ACCESS THE SARS ONLINE REGISTRATION PORTAL TO LOGIN OR REGISTER

REGISTER AS A TAXPAYER

Registering for tax via eFiling

Registering for tax in the SARS branch

Before you go to the branch, make sure you have all the supporting documents.

The following supporting documents are required:

1) Proof of identity:

- Certified or uncertified copies of a valid identity document, driving licence, passport, temporary identity document, asylum seekers certificate or permit together with the original identification (Identity document includes the green barcoded book and the smart ID card)

- In the instance where a taxpayer is a minor, a certified or uncertified copy of the minor’s birth certificate is required, along with a copy of the parent’s or guardian’s identity document. If there is no surviving parent, the death certificate of one parent must be provided by the appointed guardian.

2) Proof of Address:

The table below provides a list of documents that will be accepted by SARS as proof of a residential or business address.

The document must clearly show the taxpayer’s name (either initials and surname or first name(s) and surname) and the physical address.

| | Document description | Validity period |

|---|---|---|

| 1 | GENERAL ACCOUNTS: | |

| 1.1 | Utility account i.e. rates and taxes, water or electricity account | Less than 3 months old |

| 1.2 | Educational Institution account | Less than 3 months old |

| 1.3 | Co-op statement (for farmers) | Less than 3 months old |

| 1.4 | Medical aid statement | Less than 3 months old |

| 1.5 | Mortgage statement from mortgage lender | Less than 6 months old |

| 1.6 | Telephone account (All networks) | Less than 3 months old |

| 1.7 | e-Toll account | Less than 3 months old |

| 1.8 | SABC television licence | Less than 1 year old |

| 1.9 | Retail accounts (e.g. Woolworths, Edgars, etc.) | Less than 3 months old |

| 2 | GOVERNMENT ISSUED DOCUMENT: | |

| 2.1 | Motor vehicle licence documents | Less than 1 year old |

| 2.2 | Court order | Less than 3 months old |

| 2.3 | Subpoena | Less than 3 months old |

| 2.4 | Traffic fine | Less than 3 months old |

| 2.5 | Documentation relating to UIF or pension pay-out | Less than 3 months old |

| 3 | INSURANCE AND INVESTMENT DOCUMENT: | |

| 3.1 | Life assurance document | Less than 1 year old |

| 3.2 | Short-term insurance document | Less than 1 year old |

| 3.3 | Health insurance document | Less than 1 year old |

| 3.4 | Funeral policy document | Less than 1 year old |

| 3.5 | Investment statement from share, portfolio or unit trust | Less than 1 year old |

| 4 | LEASE/FRANCHISE AGREEMENT: | |

| 4.1 | Current and valid agreement | |

- Where proof of residence is in the name of a third party (e.g., someone other than the taxpayer name), the CRA01 must be filled in. Please note that proof of the address of the third party must be attached to the CRA01.

- A letter, or the CRA01, must be filled out by the chief or councillor if a taxpayer lives in an area where municipal accounts aren’t issued. The taxpayer must get a letter from the councillor in the area they live in. The Chief or Councillor doesn’t need to provide proof of residence or ID if the letter or CRA01 is for a third party.

- If an entity has only one director or member who is also the representative taxpayer and the business is trading from the representative taxpayer’s address, proof of residential address is needed. Where there is more than one member or director and the business is trading from one of the member or director’s addresses, the CRA01 needs to be filled in by another member or director.

- Here is the form: CRA01. Remember, certain mandatory information must be filled in before you will be able to print the form.

3) Proof of Bank Details:

- Original letter from bank not older than one month (30 days), confirming the account holder’s legal name; account number, account type; branch code and the date on which the account was opened; or

- Original bank statement or ATM / Internet-generated statement or ABSA eStamped statement not more than three months old that confirms the account holder’s legal name, bank name, account number, account type, and branch code, where applicable, or where a new bank account was opened and a bank statement cannot be produced, an original letter from the bank not older than one month on the bank letterhead with the original bank stamp reflecting the date the bank account was opened; or

- If the wife or husband does not have a bank account and chooses to use his or her spouse’s banking details, a certified copy of the marriage certificate is required. In the case of a life partner, an affidavit must be provided.

Once you’ve been registered and given your tax number, you can then register for eFiling by following the steps below, which is a free and convenient way of interacting with SARS.

All you need is a computer and internet access. As a registered eFiler, you will then be able to submit your tax return online, make payments to SARS, etc.

HOW DO I REGISTER FOR tax?

There are three ways to register for tax:

When you register for SARS eFiling for the first time and you do not yet have a personal income tax number, SARS will automatically register you and issue a tax reference number. Note that you must have a valid South African ID.

Easy steps:

- Go to www.sars.gov.za

- Select ‘Register Now’

- Follow the prompts

- Request a Notice of Registration; it will reflect your income tax registration number

You can also register for SARS eFiling on the SARS MobiApp and follow the same steps.

Register through your employer via SARS eFiling:

- SARS eFiling offers the SARS registration function, which allows employers to submit employee income tax registrations to SARS.

Register at your nearest SARS branch: (Please note that visits to SARS branches will be limited during the lockdown period.)

- Visit your nearest SARS branch to register for personal income tax. Make sure you bring along the necessary supporting documents. Remember to make an appointment before you visit a branch.

Unsure whether you are registered or not? Ask your employer, use the SARS online Query function or call our SARS Contact Centre on 0800 00 7277.

Top Tip: SARS won’t provide your tax number to another person unless the person is your tax practitioner or has a Power of Attorney (POA) to conduct your tax affairs.

REGISTER FOR EFILING

How to register

- Visit the SARS eFiling website www.sarsefiling.co.za and click on REGISTER; or

- View the MobiApp and tap on REGISTER; or

- Visit your nearest SARS branch.

Once you have registered, you can have different roles, for example:

- Acting as yourself when administering your own individual taxes;

- Acting as the registered representative or an employee for a company;

- Acting as an agent on behalf of someone else:

- Registered Tax Practitioners

- Employees with delegated authority from a registered tax practitioner

- Foreigner acting on behalf of a company or an individual.

SARS will recognise you as an electronic filer once your e-filing registration is complete.

Upon registration, SARS will verify the information captured on registration. your registration profile. The outcome of this will be communicated on your eFiling registration verification page or via email. If your registration is successful, a one-time pin (OTP) will be sent to your preferred channel of communication to allow you to complete your registration.

The statuses can either be registration successful, registration rejected, or awaiting supporting documents. If the status is not successful, the taxpayer cannot use eFiling and must respond based on the correspondence received. If the registration is rejected, the taxpayer or representative may visit their nearest branch office to register for eFiling.

SARS endeavours to activate new eFiling profiles within 48 hours where no supporting documentation is required.

Where an eFiling registration is not processed within 48 hours and supporting documents are required, please go to https://www.sarsefiling.co.za, click Login, enter your username and password you created on registration, click Home; User, and then Pending Registration, for further requirements regarding the processing of your eFiling registration.

Have you forgotten your password?

- To reset your password, fill in your registered email address and reset your password by clicking forgot password on the login page.

SOUTH AFRICAN REVENUE SERVICE (SARS) ONLINE REGISTRATION PORTAL

- SARS Login Portal: https://www.sars.gov.za

SOUTH AFRICAN REVENUE SERVICE (SARS) CONTACT ADDRESS

| Region |

Postal Address

|

Physical Address

|

Email

|

|

Region 1: Taxpayers residing in Gauteng South; the Greater Johannesburg area; East Rand; West Rand; and Mpumalanga |

Private Bag x15

Alberton 1450 |

St Austell Street

Mackinnon Crescent New Redruth Alberton 1449 |

Taxpayers: contactus@sars.gov.zaRegistered Tax Practitioners: pcc@sars.gov.za |

|

Region 2: Taxpayers residing in Gauteng north (including Centurion and Pretoria), North West, and Limpopo |

PO Box 436

Pretoria 0001

|

7 Protea Street

Centurion Pretoria 0157 |

Taxpayers: contactus@sars.gov.zaRegistered Tax Practitioners: pcc@sars.gov.za |

|

Region 3: Taxpayers residing in Kwa-Zulu Natal and the Eastern Cape |

PO Box 921

Durban 4000 |

201 Dr Pixley KaSeme Street

Durban 4001 |

Taxpayers: contactus@sars.gov.zaRegistered Tax Practitioners: pcc@sars.gov.za |

|

Region 4: Taxpayers residing in the Western Cape, the Free State and Northern Cape |

Private Bag x11

Bellville 7530 |

Corner of Teddington &

De Lange Road Bellville

7530 |

Taxpayers: contactus@sars.gov.zaRegistered Tax Practitioners: pcc@sars.gov.za |

Don’t miss out on current updates, kindly like us on Facebook & follow us on Follow @Eafinder OR leave a comment below for further inquiries.