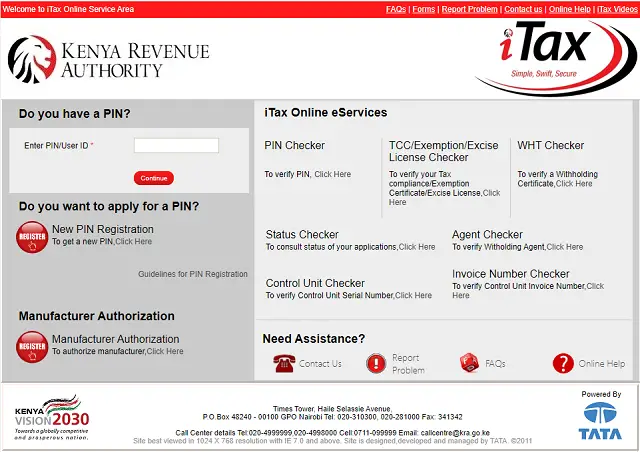

This information involves the Kenya Revenue Authority iTax Portal: https://itax.kra.go.ke. It also contains the organization’s contact address and the official website. Kindly check below for more details.

The Kenya Revenue Authority has enabled the iTax portal for tax payment and other services. The Online Portal is created for every working citizens of Kenya to create an account or log in to perform certain actions at ease e.g. tax status and account balance and so much more.

iTax is a system that has been developed by KRA to replace the current KRA Online system. iTax allows one to update their tax registration details, file tax returns using Microsoft Excel or Open Office, register all tax payments and make status enquiries with real-time monitoring of their ledger/account. It also includes the iPage which is the profile page in iTax that allows for the update of taxpayers registration details.

Some of the advantages of iTax includes.

- Access to the taxpayer ledger. including access by employees on their PAYE deductions

- Real time update of the taxpayers ledger upon filing of returns and making payment

- Tax is accessible at the comfort of the taxpayer, i.e. office or home

- Numerous payment channels – more Banks are being recruited to make payment of Domestic Taxes more convenient.

- Simpler domestic tax return filing . the returns are based on the excel format.

- Time saving.

- Reduced queuing at the banking hall

- Swift application and processing of tax related services e.g Tax Compliance Certificates, Refunds, Amendments, waivers, tax exemptions etc.

- Reduction of Refunds backlog by allowing taxpayers to utilise approved refunds to offset other tax liabilities.

- Communication via e-mail and SMS notifications upon completion of transactions.

- Electronic generation of certificates, i.e. PIN, Withholding Tax certificates, Exemption Certificates etc.

- iTax returns are excel based and therefore is easy to use. Excel also accommodates several hundred thousand columns and rows of data.

- Inconvenience caused to taxpayers through Request for records by KRA officers will be greatly reduced.

HOW TO ACCESS THE ITAX PORTAL TO LOGIN OR REGISTER

For Existing Users

The following is a guide on how to log into the iTax Portal.

- Open your internet browser e.g. Internet Explorer, Chrome, Firefox, etc.

- Go to iTax Login Portal

- Enter your PIN/User ID to log in

- Once logged in, scroll down the page to access your dashboard.

The following is a guide on how to register and log into the iTax Portal.

- Open your internet browser e.g. Internet Explorer, Chrome, Firefox, etc.

- Go to iTax Login Portal

- Kindly click on the New pin registration to get a new pin.

- Fill in the required information and submit.

- All taxpayers (individuals, companies, parastatals, NGOs, etc.) should update their information using the iPage.

- iTax provides for capture of additional registration data not previously captured. The information required in iTax includes among others your county, employer, cell phone contact, unique email address, tax agent, etc.

- Taxpayers are required to update their iPage on first log in to iTax.

- To update your iPage, go to https://itax.kra.go.ke or KRA website. On the website you will see the iTax portal banner. Click on it to access the iTax portal.When logging for the first time, the initial requirement will be updating iPage.

- One is required to fill in the mandatory fields especially under basic information then submit the data so as to update the taxpayers information with KRA.

- If you try to update your iPage but your pin is not recognized, dont panic because this happens for new PINs that have not been migrated to iTax. The taxpayer is required to send this PIN to KRA for migration through email Callcentre@kra.go.ke and DTDOnlineSupport@kra.go.ke or call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office.

- If your data is not consistent with the database, the taxpayer is required to send this PIN to KRA for data correction through email Callcentre@kra.go.ke and DTDOnlineSupport@kra.go.ke or call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office.

- If Income tax date comes before business commencement date. the taxpayer is required to send this PIN to KRA for data correction through email Callcentre@kra.go.ke and DTDOnlineSupport@kra.go.ke or call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office.

Forgotten your Password?

- To reset your password, submit your username or your email address. If we can find you in the database, an email will be sent to your email address, with instructions how to get access again.

ITAX LOGIN PORTAL

- iTax Login Portal: https://itax.kra.go.ke

ITAX PIN CHECKER

- iTax Pin Checker: https://itax.kra.go.ke/KRA-Portal/pinChecker.htm

ITAX CONTACT ADDRESS

iTax Portal Assistance

ADDRESS

- Times Tower, Haile Selassie Avenue,

P.O.Box 48240 – 00100 GPO Nairobi - Tel: 020-310300, 020-281000

- Fax: 341342

Call Center details

- Tel:020-4999999,020-4998000

- Cell:0711-099999

- Email: callcentre@kra.go.ke

Check Also:

Don’t miss out on current updates, kindly like us on Facebook & follow us on Follow @Eafinder OR leave a comment below for further inquiries.

need a job have required qulification